Cash Flow – Restaurant Budget Management

Hit your revenue and profit goals with a built-in restaurant budget tool designed for owners of independently-owned quick service restaurants, coffee shops, and food trucks

Taking the guesswork out of your restaurant budget

Cash Flow is a restaurant cash flow management tool built into the Table Needs Restaurant Operations Platform that allows restaurant owners to understand their cash flow and spend with intention.

Cash Flow Restaurant Budget Management helps owners of quick service restaurants, coffee shops, and food trucks:

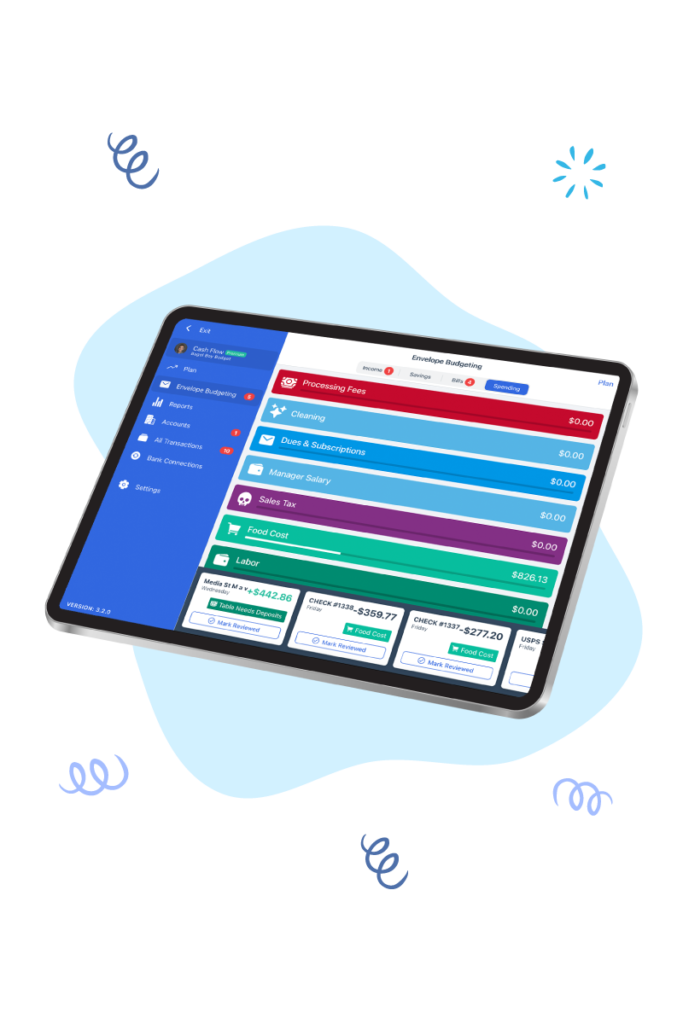

Monitor your restaurant spending and cash flow with ease

After a simple, guided set-up of your restaurant’s revenue, bills, and spending categories, Cash Flow’s intuitive features and seamless integration into the Table Needs point of sale system makes managing your restaurant’s finances easier than ever.

Improve financial stability with a week-to-week restaurant budgeting method

Stop guessing if you have enough to cover bills, payroll, and anything else mid-month and instead tap into the power of weekly cash flow management method designed to reduce financial messes.

Confidently and intentionally spend on what you need to grow your restaurant

With the Cash Flow spending management method, you’ll spend with your long- and short-term needs in mind while reducing friction with partners, managers, and employees.

Plan for current and future success with a restaurant budget tool designed for profitability

Don’t make decisions in the dark! Equipped with accurate financial projections, a balanced restaurant budget, and a solid business plan, you’ll know exactly what you need to do to grow a profitable, successful business.

Tackle your restaurant budget woes and hit new heights of profitability and financial security

Start the conversation to learn more about how Cash Flow can transform your quick service restaurant, coffee shop, or food truck.